New Year, New Goals with BOOST!

A Year of Growth with the BOOST Program

A new year is the perfect time to think about goals – things you want to work toward, learn, or save for. No matter where you are in the BOOST program, you can set goals that help you build smart money habits all year long. Below is an outline of our program and what each tier offers, so you can crush your goals no matter which part of the program you fall into.

Savings:

- We will cover the $5.00 opening deposit for you- allowing your deposits to go 100% towards savings.

- Earn 3% dividends up to a $2,500.00 balance.

- Once you make your first deposit into your savings account, we will reward you with a $25.00 deposit- on us!

- Making your first deposit also enters you into our monthly raffle, where we give away prizes like tickets to local sporting events.

- If you have made at least two deposits during the year, you are entered into our annual drawing for BOOST Savings Member of the Year- which pays out a grand prize of $250.00 for exhibiting strong savings behavior!

💡Tip- Set a savings goal in online banking to help keep yourself accountable and track progress toward something you are saving for!

Checking:

- We will cover the $5.00 opening deposit, plus deposit an additional $20 into your account!

- Once you enroll and log into online baking, we will reward you with a $50.00 deposit- on us! This shows us that you prioritize staying on top of your account.

- Enrolling and logging into online banking also enters you into our monthly raffle, where we give away prizes like tickets to local sporting events.

- Being a digital banking member also enters you into our annual drawing for BOOST Checking Member of the Year- which pays out a grand prize of $500.00 for showing strong money management and account monitoring skills!

- You’ll have the option for a debit card and can track your spending via our online banking.

💡Tip- Checking your balance and transactions regularly helps you stay in control of your money and on path to achieving your goals!

Credit:

- The limit on your BOOST credit card will not exceed $1,000.00- this helps keep debt low and payments manageable.

- The interest rate on the card will always be our lowest at 9.9%

- We will load rewards points onto your card which you can redeem for merchandise or a statement credit.

- Achieving a credit score of 740+ enters you into our annual drawing for BOOST Credit Member of the Year- which pays out a $2,000 scholarship for exhibiting strong credit building skills!

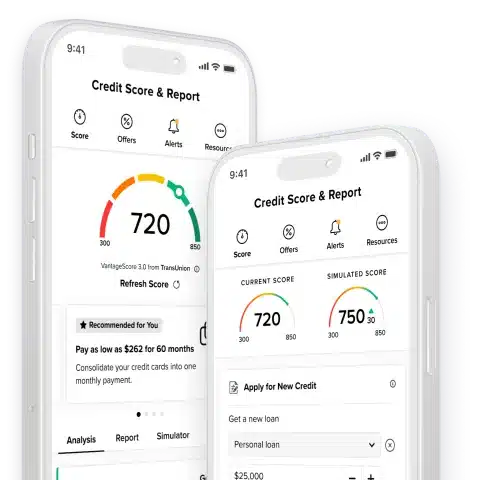

💡Tip- Monitor your credit score and report via online banking with our SavvyMoney widget. This will help keep you on track to achieving your goal of a 740 or higher credit score!

No matter which BOOST program you’re in, goals help you:

- Stay focused

- Make sound money decisions

- Feel proud of what you accomplish

Here’s to a year of learning, growing, and BOOSTing your financial skills — one goal at a time 🎯